Revolutionizing Financial Data Sharing in India: The Account Aggregator Ecosystem

In the age of digital finance, the way we manage, share, and utilize financial data is undergoing a transformative change. At the heart of this change in India is the innovative Account Aggregator (AA) ecosystem, a groundbreaking initiative that's reshaping the landscape of financial data sharing. Conceived and regulated by the Reserve Bank of India (RBI), this ecosystem stands as a testament to India's commitment to leveraging technology for financial empowerment and inclusion.

The Account Aggregator system emerges as a response to a longstanding challenge: the cumbersome and insecure processes involved in sharing financial information between financial institutions and consumers. Traditionally, sharing financial data, such as bank statements or transaction histories, with financial service providers was a process fraught with inefficiencies and privacy concerns. It required consumers to manually collate and share sensitive information, often leading to delays and potential security risks.

Enter the Account Aggregator network, a digital platform that revolutionizes this process by enabling a seamless, secure, and consent-based sharing of financial data. This initiative is not just a technological leap but also a significant move towards giving consumers control over their financial information. By simplifying the data sharing process, the AA system opens up new avenues for financial services, making them more accessible, personalized, and secure.

This introduction to the Account Aggregator ecosystem in India will delve into its mechanics, key players, benefits, challenges, and the profound impact it promises for the future of financial services. As we explore this innovative ecosystem, we unveil how it stands to democratize financial data, empower consumers, and catalyze a new era of financial inclusion and digital empowerment in India.

Understanding the Account Aggregator Ecosystem

Definition and Purpose

The Account Aggregator (AA) system, a novel financial data sharing framework in India, represents a paradigm shift in managing and sharing personal financial information. Unlike traditional methods, the AA model is built on a digital platform that facilitates the sharing of financial data between entities, but only with the explicit consent of the user. This model is primarily designed to simplify and secure the process of accessing and sharing financial data, making it more efficient for both consumers and financial institutions.

The primary purpose of the AA ecosystem is to empower individuals with control over their financial data. It enables a more accessible, transparent, and secure way for consumers to share their financial information with financial service providers, such as banks, insurance companies, and investment firms.

Historical Context

Before the advent of Account Aggregators, the process of sharing financial data in India was cumbersome, often requiring physical document submission and posing significant privacy risks. This inefficiency was a barrier to financial inclusion and the optimal utilization of financial services. The RBI, recognizing the need for a more streamlined and secure data-sharing process, paved the way for the AA system. This innovation is part of a broader push towards a more digital and inclusive financial system in India, aligning with initiatives like the Unified Payments Interface (UPI) and Aadhaar.

Regulatory Backing

The Reserve Bank of India (RBI) plays a pivotal role in the AA ecosystem, providing the necessary regulatory framework and oversight. The RBI, along with other regulatory bodies like the Securities and Exchange Board of India (SEBI), Insurance Regulatory and Development Authority of India (IRDAI), and Pension Fund Regulatory and Development Authority (PFRDA), has set guidelines and standards for the functioning of AAs. This regulatory backing not only ensures the smooth operation of AAs but also instills trust and confidence in the system among consumers and financial institutions.

The Mechanics of the AA System

How It Works?

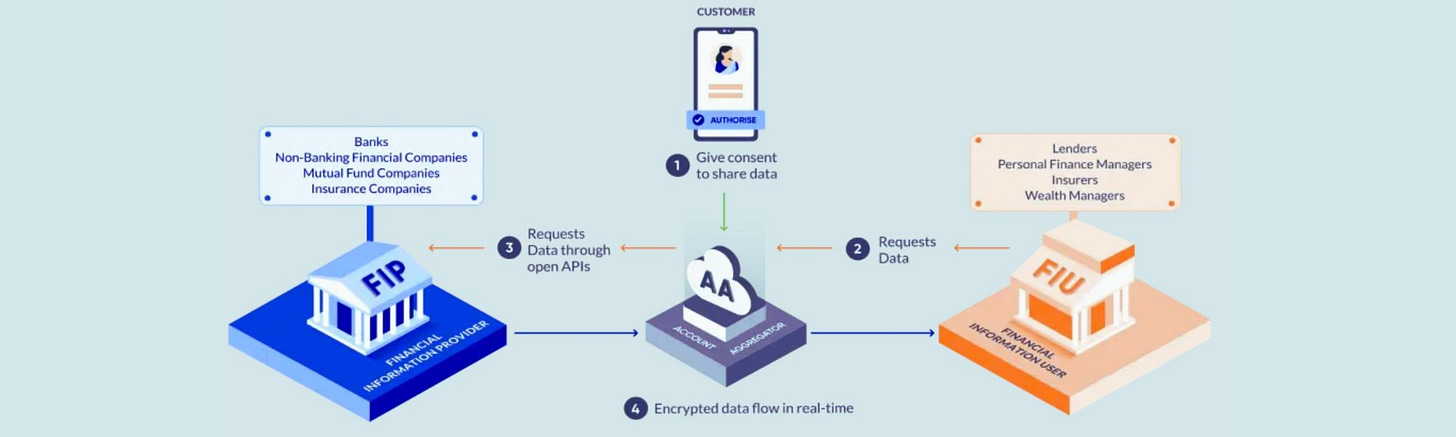

The Account Aggregator system operates on a digital framework enabling a secure and efficient transfer of financial information. The process begins when a consumer needs to share financial data, like bank statements or tax returns, with a financial information user (FIU). Instead of the traditional, manual methods of data sharing, the consumer uses an AA to facilitate this process.

Here's a step-by-step breakdown of the AA process:

Consent Request: The financial information user(FIU) sends a request for information through the AA.

Consumer Consent: The AA then forwards this request to the consumer, who can review and provide explicit consent for data sharing.

Data Retrieval and Transfer: Upon receiving consent, the AA retrieves the data from the respective financial information provider (FIPs) and securely transfers it to the FIU.

This model ensures that the consumer's data is shared securely and only for the purposes they have consented to, aligning with data privacy norms.

Technology Infrastructure

The technology behind AAs is centered on security and privacy. Utilizing advanced encryption and secure data transmission protocols, AAs ensure that consumer data is protected against unauthorized access. This system is built on APIs (Application Programming Interfaces) that enable seamless data flow between different entities while maintaining high data integrity and security standards.

Participants in the Ecosystem

The AA ecosystem comprises several key participants:

Account Aggregators: Authorized by the RBI, AAs are entities that facilitate the data sharing process. They do not store data but act as data transfer channels.

Financial Information Providers (FIPs): These are entities that hold financial data, such as banks, tax authorities, and mutual fund houses.

Financial Information Users (FIUs): These include banks, NBFCs, and other financial institutions that need access to consumer financial data for providing services.

Consumers: The central figures in this ecosystem, consumers have complete control over their data. They decide what information to share, with whom, and for how long.

Benefits and Challenges of the Account Aggregator Ecosystem

Empowering Consumers

The most significant benefit of the AA system is the empowerment it offers to consumers. By putting them in control of their financial data, it transforms the way financial services are accessed and utilized. Key aspects of this empowerment include:

Consent-Based Sharing: Consumers can choose what financial data to share and with whom, ensuring greater control over their personal information.

Improved Access to Financial Services: With easier access to their financial data, consumers can more readily avail of financial services such as loans and investments, tailored to their needs.

Enhanced Privacy and Security: The AA's digital framework ensures that financial data is shared securely, minimizing the risk of data breaches and fraud.

Enhancing Financial Inclusion

The AA ecosystem plays a crucial role in enhancing financial inclusion, particularly for underserved segments of society. By simplifying the process of data sharing, it helps in:

Reducing Documentation Hassles: Consumers no longer need to physically provide extensive documentation when applying for financial services.

Enabling Better Credit Decisions: Financial institutions can make more informed credit decisions with easier access to a customer's comprehensive financial profile.

Supporting Micro and Small Enterprises: SMEs benefit from streamlined access to credit and other financial services, vital for their growth.

Potential Challenges

While the AA system brings numerous benefits, it also faces several challenges that need to be addressed:

Technology Adoption: The success of the AA system hinges on widespread adoption by financial institutions and consumers, which can be hindered by technological or operational constraints.

Data Privacy Concerns: Despite the system's strong focus on security, there is always a concern about data privacy, particularly how data is used by FIUs.

Digital Divide: In a country as diverse as India, the digital divide can limit the accessibility of the AA system to all segments of the population, especially in rural or less technologically advanced areas.

Use cass of the Account Aggregator Ecosystem

The true potential of the AA system is best understood through its practical applications and the real-world benefits it offers to various stakeholders in the financial sector. Following are some use cases for FIU

Risk Assessment: FIUs use the comprehensive financial data provided by AAs to assess the credit-worthiness of individuals and businesses. This includes analyzing income streams, spending patterns, debt obligations, and other financial behaviors.

Credit Scoring: The data obtained helps in creating more accurate and personalized credit scores. FIUs can make more informed decisions on loan approvals, interest rates, and credit limits based on the detailed financial profile of the borrower.

Financial Planning: AAs provide FIUs with a holistic view of an individual's financial landscape. This includes information on income, expenses, investments, and liabilities. FIUs leverage this comprehensive data to offer personalized financial planning advice.

Goal-Based Planning: FIUs can tailor financial planning recommendations based on the individual's financial goals, risk tolerance, and investment preferences. This ensures a more customized and effective financial strategy.

Personalized Financial Product Offerings: FIUs use the data to understand the specific financial needs and preferences of customers. This enables them to offer targeted and personalized financial products, such as insurance plans, investment products, and credit facilities.

Cross-Selling Opportunities: A comprehensive financial profile allows FIUs to identify cross-selling opportunities. For example, if a customer has a substantial savings account balance, FIUs may recommend investment products or wealth management services.

Fraud Detection and Prevention: FIUs leverage data analytics to detect anomalies and patterns that might indicate fraudulent activities. Unusual transactions or deviations from established financial behaviors can trigger alerts, enabling prompt action to prevent fraud.

Enhanced Security Measures: The detailed financial data obtained through AAs helps FIUs implement robust security measures, reducing the risk of identity theft and unauthorized access to financial accounts.

Compliance and Reporting: FIUs use the data to ensure compliance with regulatory requirements. This includes adherence to know your customer (KYC) norms, anti-money laundering (AML) regulations, and other legal obligations.

Auditing and Reporting: The data obtained is instrumental in auditing processes and generating comprehensive reports for regulatory authorities, demonstrating compliance and transparency in operations.

Conclusion: Transforming India's Financial Landscape Through the Account Aggregator Ecosystem

As we navigate the complexities and opportunities of the Account Aggregator system, it becomes increasingly clear that this initiative is more than just a technological innovation; it's a transformative force reshaping India's financial landscape. By empowering consumers with unprecedented control over their financial data and streamlining the data sharing process, the AA ecosystem is setting new standards in financial transparency, efficiency, and inclusivity.

The potential of the AA system to revolutionize financial services in India is immense. By bridging gaps in financial inclusion, enhancing consumer privacy and security, and enabling a more efficient financial services marketplace, AAs have the power to catalyze a new era of economic growth and empowerment. However, as with any groundbreaking initiative, the journey will not be without its challenges. Addressing concerns around technology adoption, data privacy, and the digital divide will be critical to realizing the full potential of this ecosystem.

Looking ahead, the Account Aggregator system has the potential to serve as a model for other countries exploring similar transformations in financial data management and sharing. The success of this ecosystem will hinge on continued collaboration among regulators, financial institutions, technology providers, and, most importantly, the consumers themselves.

In conclusion, the Account Aggregator ecosystem stands as a beacon of innovation in the financial sector, promising a future where financial services are more accessible, secure, and tailored to the needs of every Indian. As this ecosystem evolves, it will undoubtedly continue to influence not only the financial sector but also the broader trajectory of digital empowerment and economic progress in India.